Table of Contents

As startups embark on their growth journey, one of the most critical decisions founders face is selecting the right financing method. Most early-stage businesses lack sufficient internal resources to develop new products, expand teams, invest in marketing, or scale operations. At this point, among the many available financing options, equity financing and debt financing emerge as the two most fundamental models.

Both methods provide access to essential capital, but they differ significantly in terms of financial risk, ownership structure, cost of capital, and long-term impact. Whether you’re considering venture capital or applying for a traditional bank loan, understanding the pros and cons of each option is key to building a sustainable growth strategy.

What Is Equity Financing?

Equity financing involves raising capital by selling shares of your company to investors. These investors may include venture capital funds, angel investors, crowdfunding participants, or private equity firms. In return, they share in the company’s profits or potential returns from a liquidity event such as an acquisition or IPO.

Advantages of Equity Financing:

• No repayment obligation: Unlike debt, there are no monthly payments, helping preserve cash flow and reduce short-term financial risk.

• Strategic support: Investors provide not only capital but also mentorship, networks, and industry insights.

• Shared risk: Financial risk is distributed among investors.

• Ideal for high-risk ventures: Often the only viable option for startups in early growth stages or volatile markets.

Disadvantages:

• Dilution of ownership: Founders may lose a portion of ownership and decision-making power.

• Investor influence: Strategic decisions often require alignment with investor interests.

• High capital cost: In the long term, equity can be more expensive as investors expect high returns.

Equity financing is suitable for startups with high growth potential but limited financial history or steady cash flow. If the priority is support and scale over full ownership, this method may be the right fit.

What Is Debt Financing?

Debt financing refers to raising capital by borrowing funds, typically through loans. These loans may come from banks, traditional lending institutions, or online alternative lenders. Startups may also explore secured loans, revenue-based financing, or asset-backed lending options.

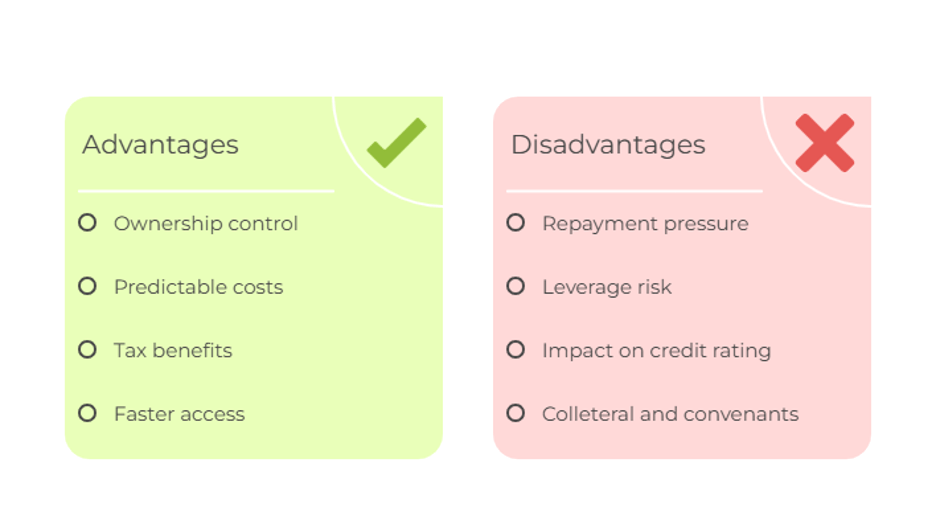

Advantages of Debt Financing:

• Ownership is preserved: Founders retain full control over the business.

• Predictable costs: Fixed interest rates and regular payment schedules aid in budgeting.

• Tax benefits: Interest payments are often tax-deductible.

• Faster access: Loan approvals can be quicker than equity funding rounds.

Disadvantages:

• Repayment obligations: Loans must be repaid regardless of business performance, potentially straining cash flow.

• Impact on credit rating: Missed payments can negatively affect the company’s credit score.

• Collateral and covenants: Lenders may require personal guarantees, collateral, or impose financial restrictions.

• Leverage risk: Increased debt can raise the company’s financial risk.

Debt financing is often suitable for businesses with steady revenue, defined growth projects, and short-term capital needs.

Key Considerations in the Decision-Making Process

There is no one-size-fits-all answer when choosing between equity and debt. Startups should evaluate the following factors:

• Stage of growth: Early-stage startups may find equity more accessible, while established businesses may benefit more from debt.

• Cost of capital: Equity tends to be more expensive than debt in the long term.

• Leverage and obligations: High levels of debt can increase financial risk.

• Risk tolerance: Risk-averse founders may lean toward equity, while aggressive founders may prefer debt.

• Tax implications: Debt may offer cost advantages due to interest deductibility.

• Market conditions: In tight capital markets, debt may be more accessible than equity.

• Ownership and strategic value: If seeking mentorship, industry connections, and strategic guidance, equity may be more advantageous.

• Loan covenants: Debt agreements may restrict dividends, additional borrowing, or asset sales.

Some companies opt for hybrid financing models, combining both equity and debt. For example, a startup may raise equity in a seed round and then secure a loan to meet short-term needs.

How to Choose the Right Financing Model for Your Startup

Choosing between equity and debt financing is not solely a financial decision—it is directly tied to your startup’s current situation, growth plans, and strategic goals. If long-term investor support, industry expertise, and global networks are critical for your business, equity financing may be the better choice. However, if you wish to retain full control and have consistent revenue to manage repayments, debt financing may offer greater flexibility.

The costs, risks, and benefits of both models should be thoroughly compared. If appropriate, hybrid solutions should also be considered. This comprehensive approach will provide a solid financial and strategic foundation for your startup’s sustainable growth.