Table of Contents

- The Meaning of M&A Processes for Companies

- The Strategic Contribution of Advisory

- In-Depth Analysis of Financial Risks

- The Legal Dimension and Ensuring Compliance

- Managing Cultural Differences

- Accurate Valuation Processes

- Strategic Moves in the Negotiation Phase

- Relations with Regulations and Public Authorities

- Reputation Management and Stakeholder Communication

- Technology-Oriented Risks and Solutions

- Challenges of Post-Acquisition Integration

- Lessons Learned from Failed Cases

- Key Criteria for Selecting the Right Advisor

- The Impact of Digitalization on Advisory

The Meaning of M&A Processes for Companies

Mergers and acquisitions (M&A) have become one of the most powerful tools for companies to achieve sustainable growth in today’s highly competitive environment. Since companies struggle to increase market share solely through organic growth methods, they turn to different strategies. At this point, M&A provides companies with opportunities such as entering new markets, accessing technological capabilities, scaling faster than competitors, and gaining a competitive edge. Especially in industries like finance, energy, technology, and healthcare, mergers and acquisitions are critical not only for growth but also for long-term survival. However, alongside these advantages, a wrong move can jeopardize the entire strategy. Therefore, M&A processes are not just a commercial decision but a turning point that shapes the future of the company.

The Strategic Contribution of Advisory

An M&A process is not limited to the merging of two companies or one company acquiring another; it also means achieving long-term strategic alignment. This is where advisory comes into play, adding not only technical but also strategic value to the process. Professional advisors analyze whether the target company is aligned with the strategic vision and guide the management accordingly. For instance, a deal that looks profitable in the short term might conflict with the company’s long-term growth plans. At this stage, advisors’ foresight prevents executives from making costly mistakes. Strategic advisory not only minimizes risks but also ensures that opportunities are correctly identified and maximized. Thus, an M&A transaction becomes more than just an agreement, it turns into a powerful move shaping the future of the company.

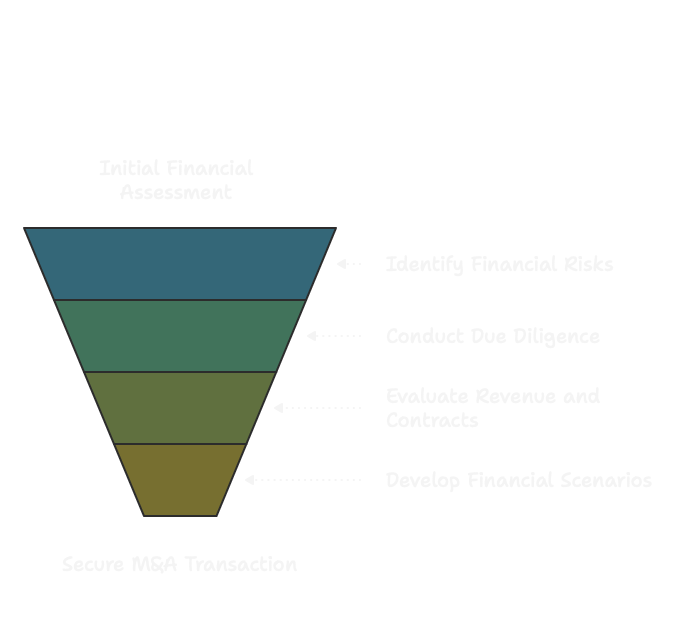

In-Depth Analysis of Financial Risks

Financial risks are often one of the most critical breaking points in M&A processes. Hidden debt burdens, misstated balance sheets, or unsustainable cash flows of the target company can pose significant threats after the acquisition. For this reason, professional advisors conduct detailed financial due diligenceto thoroughly analyze the company’s financial structure. Beyond financial statements, revenue projections, sustainability of customer contracts, and debt repayment capacity are also evaluated. Even a small mistake in large-scale transactions can lead to losses worth billions for the acquiring company. Advisory does not only identify risks but also develops alternative financial scenarios, providing the management with a realistic decision-making framework. This ensures that M&A transactions are financially secure and predictable.

The Legal Dimension and Ensuring Compliance

Without legal compliance, even the most promising M&A deals can collapse in the long run. Different national and international regulations can create serious risks after the merger. For example, a transaction that violates competition laws may be canceled or result in heavy fines. Likewise, incomplete contracts, unprotected intellectual property rights, or ignored employee rights can lead to major legal crises for the acquiring company. Advisors guide the legal process at every stage, ensuring contracts are complete, intellectual property is safeguarded, and the entire transaction complies with regulations. In this way, M&A transactions are secured not only for the present but also against potential future legal risks.

Managing Cultural Differences

Although financial or legal risks often dominate M&A discussions, cultural incompatibility is frequently the main reason for failure. Differences in management styles, decision-making cultures, leadership approaches, or employee engagement can negatively affect integration. This often leads to low motivation and high employee turnover. Advisors analyze company cultures before the merger, identify potential conflict points, and act as a bridge during the integration process. Research shows that nearly one-third of failed M&A deals result from cultural misalignment. Therefore, cultural analysis and integration planning are among the most critical contributions of advisory.

Accurate Valuation Processes

One of the most sensitive stages of M&A is accurately valuing the target company. A valuation based solely on balance sheets often fails to reflect the full picture. Market competition, quality of the customer base, technology infrastructure, brand value, and future growth potential are also part of the equation. Advisory firms combine multiple valuation methods such as discounted cash flow (DCF), multiples analysis, and peer comparisons to achieve more accurate results. An incorrect valuation can lead to overpaying for a company or missing out on valuable opportunities. Thanks to professional advisors, valuation becomes not just a technical task but also a strategic analysis that reflects the real worth of the target company.

Strategic Moves in the Negotiation Phase

Negotiations are one of the most critical stages that determine the fate of an M&A process. A wrong negotiation strategy can harm the company’s interests or even cause the deal to collapse. Advisors, with their sectoral expertise and experience, create a stronger position at the table and guide the process in favor of the acquiring company. They provide support not only in pricing but also in areas such as payment terms, warranties, employee rights, and integration conditions. Advisory during negotiations ensures that the post-acquisition process proceeds smoothly. Every move made during negotiations has a direct impact on the long-term financial and strategic success of the transaction.

Relations with Regulations and Public Authorities

In M&A processes, regulations represent one of the most critical risk areas. Especially in cross-border deals, varying competition laws, tax authorities, and trade rules complicate the process. Mismanaging regulatory requirements can result in deal cancellation or heavy fines. Professional advisors anticipate regulatory risks at both local and global levels and ensure proper communication with public authorities. Thus, mergers and acquisitions become not only financially viable but also legally sustainable.

Reputation Management and Stakeholder Communication

M&A processes directly affect not only company owners but also employees, customers, and investors.Poorly managed communication may create distrust among employees, loss of loyalty among customers, and concerns among investors. Therefore, reputation management and effective communication strategies are key elements of the process. Advisors ensure that the right messages are delivered at the right time, protecting the company’s brand value. Core pillars of an effective communication strategy include:

- Employee communication: Transparent messages that reduce concerns and reinforce trust.

- Customer relations: Clear assurances that service quality will remain unaffected.

- Investor updates: Financial transparency and a clearly defined future vision.

A well-managed communication process ensures that a merger transforms into not just a financial but also a cultural and organizational success.

Technology-Oriented Risks and Solutions

Today, technology-oriented risks play a critical role in M&A. Software incompatibilities, cybersecurity vulnerabilities, and IT infrastructure integration issues can create severe problems. Especially in the digital era, whether the target company’s technology infrastructure is compatible with the acquiring company significantly impacts the deal’s success. Advisors conduct technology due diligence to identify risks early and design integration plans. These efforts ensure:

- Early detection of data security gaps

- Preparation of software and hardware integration roadmaps

- Minimization of costs from technological incompatibilities

This process not only secures current systems but also guarantees alignment with the company’s future digitalization strategies.

Challenges of Post-Acquisition Integration

The real success of an M&A process is measured by how well post-acquisition integration is managed.Combining operations, processes, and human resources may look simple on paper but is complex in practice. Advisors design comprehensive plans to ensure operational alignment, employee engagement, and harmonization of financial systems. Key aspects of successful integration include:

- Standardizing common processes

- Integrating human resources and maintaining employee motivation

- Aligning financial and operational systems

- Implementing cultural integration plans step by step

If integration is not managed correctly, all advantages gained through acquisition can quickly be lost. Thus, advisors serve as the key factor that transforms integration into success.

Lessons Learned from Failed Cases

Many failed M&A deals highlight the vital importance of advisory. Poor valuation, cultural misalignment,or regulatory non-compliance have led to the collapse of deals worth billions. For example, hidden debts or unsustainable financial burdens revealed after acquisitions have caused major losses for acquiring companies. These cases prove that advisory is not just supportive but the critical difference between success and failure. For companies, the key lesson is to learn from past mistakes and apply those insights to make better-informed decisions in future transactions.

Key Criteria for Selecting the Right Advisor

The success of an M&A process depends on choosing the right advisor. Sector expertise, past experience, and references play a critical role. Choosing the wrong advisor may result in acquiring the right company under the wrong terms. To make the right choice, companies should consider the following:

- Sector-specific expertise and prior experience in similar transactions

- References and proven success stories

- Alignment with the company’s vision and culture

- A strong and multidisciplinary team structure

Advisor selection requires not only technical knowledge but also strategic alignment and mutual trust.Companies should approach this decision with utmost diligence.

The Impact of Digitalization on Advisory

Digitalization is transforming M&A advisory fundamentally. AI-powered analyses, big data-driven valuation methods, and digital due diligence tools now make processes faster, more transparent, and more predictable. These tools bring significant advantages in evaluating complex financial data and identifying risks early.

- AI analyses uncover hidden risks and opportunities more quickly.

- Big data improves the accuracy of decisions.

- Digital platforms accelerate and streamline communication between stakeholders.

In the future, M&A advisory is expected to become more proactive, more analytical, and more reliablethanks to the opportunities offered by digitalization.