Table of Contents

- 1. What Is Fundraising Advisory?

- 2. How Does the Fundraising Process Work?

- 3. Why Should You Engage Professional Advisory?

- 4. Why Is Strategic Planning the Cornerstone?

- 5. How Is the Corporate Structure Strengthened?

- 6. Why Are Financial Modeling and Projections Important?

- 7. How Are Investor Pitching and Storytelling Done?

- 8. What Is a Data Room and Why Prepare One?

- 9. How to Identify the Right Investors?

- 10. How Should Investor Meetings Be Managed?

- 11. How Are Valuation and Negotiations Managed?

- 12. Why Is Post-Investment Corporate Readiness Necessary?

- 13. How Are Investor Relations Managed?

- 14. What Are the Long-Term Effects of Professional Advisory?

1. What Is Fundraising Advisory?

Fundraising advisory is a professional service that helps startups plan their investment processes strategically, operationally, and financially. It enables founders to treat a round not merely as capital raising, but as a corporate transformation journey.

The investment process combines many components at once, financial statement preparation, data room setup, investor deck, strategic positioning, and meeting management. Getting all of these right and on time is only realistic with experienced advisory support.

Advisory not only accelerates the process but also boosts credibility in the eyes of investors, prevents costly strategic mistakes, and provides a stronger position at the negotiation table.

2. How Does the Fundraising Process Work?

A typical round unfolds in three stages: preparation, investor outreach, and closing.

In the preparation stage, the company builds its strategic plan, prepares the financial model, strengthens corporate governance, and crafts the investor presentation, the foundation where investor trust is formed.

The second stage is identifying the right investors and initiating meetings. Timing matters as much as reaching the right profiles; not every investor fits every startup, so strategic matching is essential.

The third stage covers valuation, negotiation, legal documents, and closing. This phase is both technical and strategic. Advisory ensures each stage runs in the right sequence, with solid preparationand an effective strategy.

3. Why Should You Engage Professional Advisory?

Fundraising rounds are inherently complex. Timing errors, missing documentation, or a poor investor fit can prolong or even sink the process.

Professional advisors prevent these pitfalls from the outset. Because they understand both the startup landscape and investor expectations, they manage the journey with the right strategic perspective.

Advisory is not just “technical help”; it makes the startup appear more credible, prepared, and professional.

Behind many successful rounds lies not only a great founder but a well-planned advisory process.

4. Why Is Strategic Planning the Cornerstone?

Strategic planning should be the first step for any startup preparing to raise. Investors care not only about today, but also about the plan for tomorrow.

A solid plan clarifies market position, competitive advantages, growth goals, capital needs, and post-investment steps. A vague plan signals uncertainty, which negatively affects investment decisions.

Through advisory, the plan is structured to meet investor expectations. Startups can highlight current strengths and draw a clear vision for post-funding growth.

5. How Is the Corporate Structure Strengthened?

One of the key investor concerns is the startup’s corporate structure from legal status and shareholder agreements to trademarks and IP. Investors fund not only a product or idea, but the organizational reliability behind it.

A strong structure signals controlled risk, transparent processes, and legal safety. Missing trademarks, messy agreements, or IP ambiguity can hurt investor confidence.

Advisory identifies and fixes gaps early: organizational cleanup, agreement revisions, and trademark and patent protection. As a result, the company sits at the table ready and credible.

6. Why Are Financial Modeling and Projections Important?

For investors, financials are more than reports, they’re a window into the future. Revenue forecasts,cost projections, growth plans, profitability targets, cash flow, and unit economics sit at the core of decisions.

Investors scrutinize metrics like ARR, MRR, CAC, LTV, gross margin, and runway. Gaps or inconsistencies erode trust. A well-built model shows not only today but how the company will scale after the round.

Advisors ensure numbers are soundly constructed and presented in investor language. Transparent costs, rational revenue drivers, and clear scale plans provide negotiation leverage, positioning the startup as ready to grow, not just seeking funds.

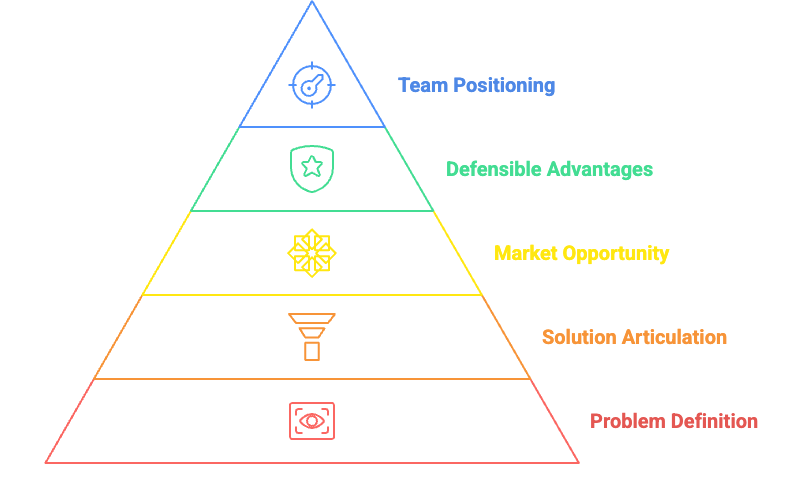

7. How Are Investor Pitching and Storytelling Done?

The investor deck is the most visible stage and thus a strategic communication tool. It must not only describe the product but tell a compelling story.

An effective deck clearly defines the problem, articulates the solution, quantifies market size and opportunity, highlights defensible advantages, and positions the team as a strategic asset.

Advisory closes the gap between founder perspective and investor perspective, structuring the narrative in investor-friendly terms. The deck becomes not just informative but persuasive.

8. What Is a Data Room and Why Prepare One?

Investors expect transparency and accessible information. A data room is a structured digital space for due diligence, housing financials, legal docs, trademarks and patents, customer contracts, business plans, operational reports, and team information.

Missing or disorganized files cause trust issues and delays. Advisory ensures the set is complete, accurate, and properly categorized. A well-prepared data room speeds up the process, boosts investor confidence, and raises close rates.

9. How to Identify the Right Investors?

Not every investor fits every startup. Sector fit, stage, check size, geo focus, and strategy shape selection. To use time and resources well, founders must target the right investors.

Advisors leverage broad networks, databases, and experience to shortlist best-fit investors, not just anyone. The goal is strategic matching.

For example, an early-stage startup chasing late-stage funds wastes time. Targeting investors aligned with scale plans accelerates the process and raises the odds of success.

10. How Should Investor Meetings Be Managed?

Investor meetings are more than pitching. You must build trust, communicate the right messages, and grasp the other side’s priorities. Investors weigh not only numbers but the founding team’s vision, strategic judgment, and crisis posture.

Advisory drives professional pre-meeting prep: tailored question banks, message maps by investor profile, and post-meeting follow-up systems.

First impressions matter, many investors shape decisions after the first meeting. Entering with corporate discipline and a clear plan can define the outcome.

11. How Are Valuation and Negotiations Managed?

Valuation and negotiations are sensitive. Valuation is not just a number; it reflects current performanceand future potential.

Overpricing can scare investors; underpricing can hurt future growth. Advisory crafts a negotiation strategy that protects the startup’s interests, manages expectations, supplies sound arguments, and keeps the process balanced through closing including analysis of investor bargaining positions to strengthen the startup’s hand.

12. Why Is Post-Investment Corporate Readiness Necessary?

Closing a round is not the finish line, but a new start. After funding, the company should not only have more capital but also higher corporate maturity.

Teams expand, operations scale, and market expansion goals emerge. This requires the right org design, robust financial reporting, and transparent governance. Investors expect regular performance tracking, progress updates, and strategic communication.

Advisory makes the new period planned and measurable, aligns operations with investor expectations, and prepares the company for stronger future rounds.

13. How Are Investor Relations Managed?

Investor relations are the backbone of the post-investment period, not just reports or updates, but a pillar of long-term growth.

Regular updates, performance reports, strategic news, and a transparent tone reinforce investor trust, which sustains current support and attracts new investors later.

Advisory helps set up professional IR systems and governance rhythms.

14. What Are the Long-Term Effects of Professional Advisory?

Fundraising advisory is not just a round-specific service; it’s a strategic investment that strengthens long-term corporate capacity.

When done right, advisory fortifies financial structure, strengthens market position, builds investor confidence, and prepares the company for future rounds.

A startup with solid governance, a clear financial model, an effective pitch, a complete data room, and strong investor relations becomes a credible, enduring player in the ecosystem. That is why fundraising advisory shapes not only today but the company’s tomorrow.