Table of Contents

- 1. Introduction: Why the First 100 Days Matter

- 2. Dynamics of the Post-Acquisition Phase

- 3. Ensuring Cultural Alignment

- 4. Strengthening Leadership and Communication Strategy

- 5. Redesigning the Organizational Structure

- 6. Technology and System Integration

- 7. Human Resources and Talent Management

- 8. Financial Control and Performance Monitoring

- 9. Managing Customer and Supplier Relationships

- 10. Risk Management and Compliance Processes

- 11. Success Metrics: Measuring the First 100 Days

- 12. Conclusion: The Foundation of Sustainable Growth

1. Introduction: Why the First 100 Days Matter

A merger or acquisition often seems to conclude with the signing ceremony, yet in reality, that’s when a new chapter begins: the post-merger integration (PMI) phase. This phase determines the company’s future strategic direction, cultural compatibility, and financial success. The first 100 days are not just about rapid decisions, they are about setting the right priorities, reinforcing employee confidence, and laying the groundwork for a new organizational culture.

Even small mistakes during this period can lead to major consequences. If the management team focuses too heavily on operational details, vision gets lost; if they focus only on culture, performance declines. Successful integration depends on balancing short-term stability with long-term transformation.

To understand the significance of the first 100 days, leaders must answer key questions such as:

• Which operational processes should be merged immediately, and which should be preserved temporarily?

• How will the new leadership hierarchy function?

• How will employees internalize the new vision?

The answers to these questions lie not only in boardroom decisions but also in day-to-day management. Thus, the PMI process should be seen not as a transition, but as a rebirth of the organization.

2. Dynamics of the Post-Acquisition Phase

The post-acquisition period is full of both uncertainty and opportunity. Many companies fall into the complacent belief that “the deal is done,” yet the real transformation begins at this stage. The key dynamic of this period is to maintain operational continuity while aligning strategic direction.

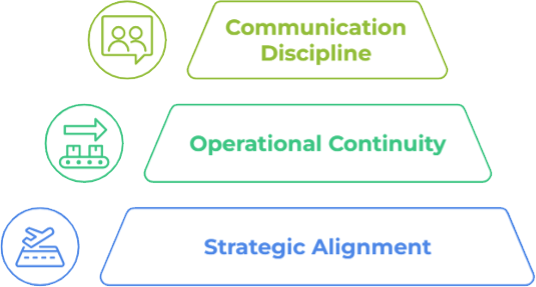

The acquired company’s existing processes must not conflict with the parent company’s goals. Otherwise, instead of creating synergy, the merger leads to wasted resources. Achieving this balance requires three main focal points:

• Strategic alignment: Both companies must synchronize their visions and growth objectives.

• Operational continuity: Daily operations must continue without disruption, and customer or supplier confidence must not be compromised.

• Communication discipline: Every department must know where it stands in the process, and silence must not allow rumors to grow.

Creating an integration committee early on plays a crucial role. Such a team ensures fast decision-making and effective coordination throughout the transformation. Successful mergers are those that treat this phase not merely as a handover, but as an opportunity to design a shared business model for the future.

3. Ensuring Cultural Alignment

Culture is the most invisible yet powerful factor in a merger. When companies with different values, leadership styles, and operating methods come together, cultural clashes are inevitable. Therefore, cultural integration should be considered as vital as financial integration in the PMI process.

Cultural alignment is not simply about employees “getting used to each other.” It is about building a shared sense of purpose. To achieve this, both organizations should identify and preserve their strongest cultural traits and define them as the new company’s core values. Leadership must visibly embody and communicate these values, while internal communication initiatives, engagement campaigns, and feedback mechanisms help establish a “we” identity.

Many companies neglect this step, resulting in declining employee engagement and increased turnover within the first six months. In contrast, companies that prioritize culture rebuild trust and morale by the end of the first 100 days. This trust becomes a long-term driver of performance, innovation, and collaboration.

4. Strengthening Leadership and Communication Strategy

A merger is not just about aligning systems, it’s about aligning people. Leadership plays a decisive role in this alignment. Visible, consistent, and trustworthy leadership is what reduces resistance to change and instills confidence during uncertain times.

The way leaders communicate during the first 100 days sets the tone for the company’s future culture. Three principles should guide this process:

- Transparency: In times of uncertainty, lack of information breeds rumors. Leaders must openly share every decision and the rationale behind it.

- Continuity: Communication should not be sporadic; it should follow a regular rhythm. Weekly updates, town halls, and short video messages can help maintain momentum.

- Accessibility: Executives should be present and approachable, engaging directly with employees’ concerns and feedback.

Effective communication is not just about transferring information, it is about creating emotional security.When employees trust their leaders, even the most radical changes become manageable. This is why the first 100 days are often described as the ultimate test of leadership capacity in any merger.

5. Redesigning the Organizational Structure

One of the most challenging aspects of the post-merger period is redesigning the organizational structure. When employees, titles, and workflows from two different companies come together, roles and responsibilities must be clearly redefined.

The most critical mistake in this phase is imposing change top-down without engagement. The redesign should be participatory, with department heads actively involved in shaping the new structure. The goal is to create leaner hierarchies that enhance decision-making speed, eliminate redundancy, and assign clear accountability to strategic roles.

Organizational restructuring cannot be captured in a single chart, it’s a redefinition of how the company operates. A well-designed structure provides direction and clarity; a poorly designed one leads to confusion and inefficiency. Every decision made in these first 100 days should be aligned with the company’s broader growth vision and strategic priorities. When done right, this process becomes the foundation for an agile, high-performing organization capable of scaling effectively.

6. Technology and System Integration

Behind every merger lies one of the most complex challenges: technology integration. Different IT infrastructures, data management systems, and digital workflows must be combined into a single, cohesive ecosystem. When managed correctly, this integration can significantly enhance decision-making capabilities and organizational efficiency.

In the first 100 days, IT and operations teams should prioritize which systems to merge first while ensuring that critical workflows remain uninterrupted. Data migration and security must be handled meticulously to prevent losses or inconsistencies. Over time, all customer, financial, and operational data should be consolidated into unified platforms to create an integrated reporting framework.

However, successful companies see technology integration not as an IT exercise, but as a strategic source of competitive advantage. Technology not only improves efficiency but also creates transparency and traceability across operations. In this sense, the success of system integration determines how effectively the organization can function as one unified entity in the post-merger environment.

7. Human Resources and Talent Management

At the heart of every merger lies the human element. Financial models, systems, and strategies only succeed when executed by the right people. Therefore, HR strategy becomes the backbone of the post-merger integration process.

During the first 100 days, employees inevitably ask, “What’s my role now?” If this question goes unanswered, uncertainty and demotivation spread quickly. HR teams must act decisively to redefine job roles, reporting lines, and performance criteria across all departments. Retention plans for key employees should be implemented immediately to prevent talent loss, and transparent communication must be maintained to keep morale high.

Mergers also have emotional consequences. HR teams must act not only as administrators but as change coaches supporting employees through training programs, mentoring, and open dialogue. In the long run, the goal is not just to retain people, but to build a new competency ecosystem that supports the company’s future direction. When handled thoughtfully, HR becomes the bridge between strategy and execution, the true enabler of integration success.

8. Financial Control and Performance Monitoring

Among all integration efforts, financial system alignment and performance monitoring are the most critical. Merging two distinct financial disciplines, reporting structures, and budgeting practices is a complex undertaking. The goal should not be limited to combining records but to establishing a common financial language under the new structure. Achieving this consistency in the first 100 days lays the groundwork for long-term synergy.

Finance teams must function not just as controllers but as strategic partners in decision-making. Each merger brings different debt levels, revenue models, and cost structures. This makes early-stage cash flow management, capital optimization, and liquidity tracking vital. Without strong financial foundations, even the most promising mergers risk instability.

Transparency is equally important. Leadership must openly communicate cost synergies, potential risks, and investment priorities to all stakeholders. Such openness builds confidence among both internal teams and investors. In the long run, financial integration becomes more than just accounting alignment, it becomes the structural backbone of the company’s growth story.

9. Managing Customer and Supplier Relationships

The post-merger period affects not only internal operations but also external stakeholders. Customers, suppliers, and business partners closely watch how changes unfold. Therefore, external communicationmust be managed with as much care as internal integration.

After a merger is announced, customers often wonder whether service quality will remain consistent, whether pricing will change, and whether existing contracts will still apply. The company must proactively reassure them that the transition will lead to greater efficiency and reliability, not disruption. At the same time, supplier agreements should be reviewed, payment terms clarified, and operational processes streamlined to prevent friction.

Uncertainty on the supplier side can disrupt production and logistics. Regular communication and transparency about the benefits of the new structure are crucial to maintaining confidence. Successful mergers are those that not only align their internal operations but also stabilize their broader ecosystem. Sustainable growth depends not just on internal efficiency but on continuity of trust throughout the value chain.

10. Risk Management and Compliance Processes

Every merger inherently carries uncertainty. If these uncertainties are not carefully managed, they can undermine the company’s reputation, financial health, and legal standing. Therefore, in the first 100 days, risk management must evolve from a control function into a strategic enabler of sustainability.

As the organization’s scope expands across new regions or sectors, its exposure to different regulatory systems and operational risks increases. This makes it necessary to conduct a comprehensive risk assessment early on redefining financial, operational, and legal risks under the new structure. In cross-border mergers, aligning policies with varying data protection laws, employment regulations, and compliance standards becomes essential.

Compliance should not be treated as a bureaucratic requirement but as part of the corporate culture. Ethics policies, internal audits, and compliance frameworks should be revisited and adapted to the new organizational reality. An effective risk governance framework doesn’t just prevent crises; it builds resilience and trust across stakeholders. The most successful mergers are those that anticipate risks and address them with proactive, well-structured solutions.

11. Success Metrics: Measuring the First 100 Days

The success of a merger can only be truly assessed through measurable outcomes. However, success metrics should not be confined to financial indicators. Cultural integration, employee engagement, customer satisfaction, and operational continuity are equally important.

Establishing a measurement system during the first 100 days ensures transparency and accountability. The data collected during this period serves as the foundation for future strategic decisions. Revenue fluctuations may occur in the short term, but these variations often reflect natural market adjustments rather than failure. The key is to interpret these shifts accurately and act decisively to stabilize performance over time.

Performance measurement should be a tool for forward-looking management rather than retrospective evaluation. The first 100 days provide invaluable insight into what is working and what requires refinement. Companies that view performance tracking as a continuous learning and adaptation process are the ones that turn short-term progress into long-term success.

12. Conclusion: The Foundation of Sustainable Growth

The true success of a merger or acquisition is not measured on the day the deal is signed, but on the day the integration is complete. The first 100 days represent the most decisive period of this journey. Every action taken during this time lays the foundation for both present operations and future strategy.

A successful post-merger integration depends as much on cultural unity, human-centered leadership, and transparency as it does on financial performance. In the long term, the goal of a merger is not merely to combine two entities but to create one cohesive identity with a shared vision. Achieving that vision requires discipline, clear communication, and timely decision-making during the early days of integration.

Ultimately, integration success goes beyond numbers, it is about building trust, transparency, and a shared culture of progress. The true value of a merger lies not just in its potential for synergy but in the organization’s ability to transform that synergy into a sustainable source of collective strength.Completing the deal is only the beginning; keeping it alive requires vision, leadership, and perseverance.