Table of Contents

The pre-seed investment stage is one of the most exciting yet challenging periods for entrepreneurs. At this stage, idea-stage ventures meet professional investors for the first time and enter into a critical funding search to grow their businesses. Pre-seed financing is the first serious step startups take to turn their dreams into reality.As INVEXEN, standing out with entrepreneurship education programs, in this article we will go beyond the question “what is pre-seed investment?” and comprehensively address financing strategies for early-stage ventures. How do you transition from the idea stage to a successful pre-seed round? What do investors look for in early-stage ventures and which criteria do they focus on? Here are all the strategies and critical points you need to know to succeed in your pre-seed financing process…

What is Pre-Seed Investment?

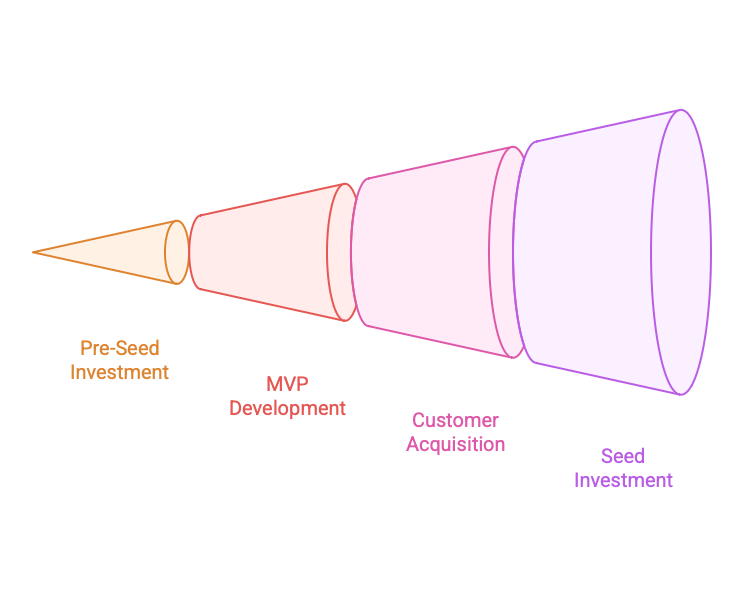

Pre-seed financing provides access to resources that startups need during the period from the idea stage to developing a minimum viable product (MVP). This investment round typically occurs in amounts ranging from 50,000 TL to 1.5 million TL. Ventures at the pre-seed stage may not yet have generated revenue. Investors at this stage focus more on the team’s potential, market size, and scalability of the business model. This investment round is a critical financing stage that comes before seed investment and helps ventures lay their foundations.The pre-seed investment stage has distinctive characteristics:

- High Risk, High Return: Ventures at this stage work with unproven business models. Investors take high risks in exchange for potentially high returns.

- Team-Focused Evaluation: Since the product has not yet been fully developed at the pre-seed stage, great importance is placed on the founding team’s experience, vision, and execution ability.

- Fast Decision Processes: Compared to seed and subsequent rounds, pre-seed investment processes generally progress faster and involve fewer bureaucratic procedures.

Position of Pre-Seed Stage in the Venture Life Cycle

Pre-seed investment holds a strategic position in the venture life cycle. This stage serves as a bridge between bootstrap (self-financing) and seed investment. Entrepreneurs complete idea validation, initial customer acquisition, and MVP development processes during this period. A successful pre-seed round plays a critical role in preparing ventures for larger investment rounds. The experience and network gained during this process provide significant advantages in subsequent periods.

Financing Sources in the Pre-Seed Stage

There are various types of sources that entrepreneurs can apply to for pre-seed financing.

- Angel Investors

Angel investors are one of the most common financing sources for pre-seed stage ventures. These individual investors are typically experienced entrepreneurs or successful figures from the business world. Angel investors not only provide financing but also offer mentorship and network support. Experienced angel investors provide strategic advice to entrepreneurs and share industry connections. This support is particularly valuable for first-time entrepreneurs. Angel investment processes are generally more flexible and faster. Angel investors can make faster decisions compared to institutional investors and require less bureaucratic process.

- Micro VC Funds

Micro VC funds are professional investment funds that make small investments in pre-seed and seed stages. These funds typically invest between 50,000 TL and 500,000 TL. Micro VCs adopt a portfolio approach and invest in numerous early-stage ventures. These funds have more structured processes than angel investors but work more flexibly than large VC funds. The number of micro VCs in Turkey has increased in recent years, and significant fundraising has occurred in this area. This development has facilitated fund access for pre-seed stage ventures.

- Accelerator Programs

Startup accelerators offer an alternative path for pre-seed financing. These programs typically provide investment at the end of an intensive 3-6 month training and mentorship process. Accelerator programs offer comprehensive training, mentorship, and networking opportunities alongside financing. Entrepreneurs receive intensive training on business model development, customer validation, and preparing presentations for investors. The best-known accelerator programs include Techstars, Y Combinator, and locally Startup.istanbul. Acceptance into these programs is a competitive process, but when successful, it provides both financing and valuable network access.

- Grants and Government Support

Grants provided by public institutions and various organizations are an important financing source at the pre-seed stage. These supports typically do not require repayment and provide valuable resources to ventures. TÜBİTAK BİGG program, KOSGEB supports, and various municipal entrepreneurship programs fall into this category. EU funds and international grant programs also offer important opportunities for entrepreneurs in Turkey. Grant application processes typically require detailed documentation and can be lengthy. However, this type of financing is very advantageous for entrepreneurs as it does not create capital dilution.

Preparing Presentations for Investors

Presentations to be made to investors at the pre-seed stage are one of the most critical components of the financing process.

- Pitch Deck Preparation

An effective pitch deck is the cornerstone of the pre-seed financing process. This presentation should typically be between 10-12 slides and clearly tell the venture’s core story.

Problem and Solution: A clear problem definition and the creative solution developed for it is critically important. Investors prefer ventures that focus on real market needs.

Market Size: Market potential must be demonstrated through TAM (Total Addressable Market), SAM (Serviceable Addressable Market), and SOM (Serviceable Obtainable Market) analyses.

Business Model: How the venture will make money, revenue streams, and scalability plans should be clearly explained.

- Financial Projection and Usage Plan

Financial projections at the pre-seed stage may not yet be fully mature, but they should still be guiding for investors. Projections should be based on realistic and defensible assumptions. The investment usage plan should be quite detailed. Investors want to know how the money received will be used and how this usage will drive growth. Typically, 60-70% of the budget is allocated to product development and team growth. Milestones and metrics should be established and success measurements defined. Investors want to see concrete indicators they can use to monitor the venture’s progress.

- Team Presentation and Credibility

At the pre-seed stage, investors largely invest in the team. The founding team’s experience, complementary abilities, and vision should be at the center of the presentation process. Each founding member’s background, areas of expertise, and contribution to the venture should be clearly stated. Previous successes, industry experience, and educational background should be highlighted. If there are gaps in the team, how these will be addressed should be planned and potential candidate profiles specified. Transparency and openness increase investor confidence.

- Demo and Prototype Presentation

When possible, presenting a working demo or prototype provides a significant advantage at the pre-seed stage. This demonstrates the venture’s execution ability and increases investor confidence. The demo doesn’t need to be perfect but should show core functions. Basic information about user experience and technical infrastructure should be shared. If there isn’t a demo yet, detailed mockups, wireframes, or prototype plans can be presented. The important thing is to make the product vision concrete.

Critical Points to Consider in Pre-Seed Investment Rounds

Important factors that entrepreneurs should pay attention to in the pre-seed financing process directly affect success.

- Valuation and Equity Distribution

The valuation determination process at the pre-seed stage is quite sensitive. High valuation can create problems in future rounds, while low valuation causes excessive dilution for founders. Market standards should be researched and valuations of ventures at similar stages should be examined. Generally, valuations between 2-8 million TL are seen at the pre-seed stage, but this varies according to sector and potential. Strategic thinking about capital dilution is necessary. Giving 10-20% equity in the pre-seed round is common. Sufficient equity pool should be left for future rounds. ESOP (Employee Stock Option Plan) planning should also be addressed at this stage. Setting aside a 10-15% stock option pool for future team growth is recommended.

- Due Diligence Process

Although the due diligence process at the pre-seed stage is simpler compared to seed and subsequent rounds, it’s still necessary to be prepared. Basic company documents, financial records, and legal documents should be kept organized. Intellectual property rights, patents, and trademarks should be researched beforehand and necessary applications made. Deficiencies in this area can slow down the investment process. Founder agreements, equity distributions, and vesting schedules should be clearly documented. Uncertainties worry investors and put the deal at risk. Getting legal advice at this stage is very important. An experienced venture lawyer provides great value in both due diligence and deal negotiations.

- Investor Selection and Compatibility

Not all money is equal; choosing the right investor provides much more value than just funding. The investor’s industry experience, network, and mentoring ability should be evaluated. The investor’s investment style and expectations should be compatible with the entrepreneur’s vision. Some investors adopt a more interventionist approach while others prefer minimal intervention. Conducting reference research is critically important. Information about working style and support quality should be obtained by talking to the investor’s portfolio companies. The investor’s follow-on investment capacity and willingness for future rounds should be researched. This can provide significant advantages in subsequent periods.

- Deal Terms and Contract Details

Pre-seed transactions typically use SAFE (Simple Agreement for Future Equity) or convertible note structures. These instruments provide fast and flexible transaction opportunities. Terms such as liquidation preference, anti-dilution rights, and board composition should be understood and their long-term effects evaluated. These rights can be critically important in future rounds. Protective clauses such as tag-along, drag-along, and right of first refusal should be reviewed and negotiated if necessary. These clauses play important roles in exit scenarios. Reporting obligations and investor rights should be kept at reasonable levels. Excessive reporting obligations can affect operational efficiency.