Table of Contents

- 1. Why Portfolio Support Matters

- 2. Understanding Modern Founder Expectations

- 3. Building a Transparent Support Framework

- 4. Strategic Alignment and Goal Setting

- 5. Operational Enablement and Scaling Support

- 6. Talent and Leadership Development

- 7. Go-to-Market and Commercial Strategy

- 8. Technology and Product Roadmap Guidance

- 9. Financial Planning and Fundraising Preparedness

- 10. Ecosystem Connectivity and Strategic Partnerships

- 11. Crisis Management and Resilience Building

- 12. Measuring Impact and Portfolio Health

- 13. Leveraging Technology for Portfolio Management

- 14. Long-Term Relationship Building and Re-Investment Potential

- 15. Turning Portfolio Support into Competitive Advantage

1. Why Portfolio Support Matters

In venture capital, investing capital is just the beginning. The real journey starts after the investment is made, when founders face market realities, resource constraints, and scaling challenges. True value creation happens when investors remain actively engaged, supporting portfolio companies beyond financial backing.

A structured post-investment support model transforms a fund from a source of money into a strategic growth partner. It means working side by side with founders, advising on market entry, pricing, team structure, and operational discipline. It also means having the courage to challenge assumptions and the empathy to guide through uncertainty.

For the fund itself, portfolio support creates measurable returns. A reputation for strong engagement attracts top founders, deepens co-investor trust, and builds a network effect that compounds over time. The ability to provide consistent, high-quality support becomes a core differentiator in a world where capital alone is no longer scarce.

2. Understanding Modern Founder Expectations

The new generation of founders is global, analytical, and execution-oriented. They have access to data, networks, and capital more than ever before, and what they now seek from investors is partnership, speed, and perspective.

Modern founders expect:

- Strategic clarity, not control.

- Access to networks, not isolated advice.

- Empathy and transparency, especially in downturns.

- Hands-on support, grounded in real operational experience.

Investors must shift from monitoring to mentoring. Founders today are looking for investors who can be sounding boards, connectors, and strategic accelerators. When funds understand this shift and deliver accordingly, they move from being seen as financiers to long-term partners in growth. This relationship dynamic is what separates passive investors from those who build enduring ecosystems.

3. Building a Transparent Support Framework

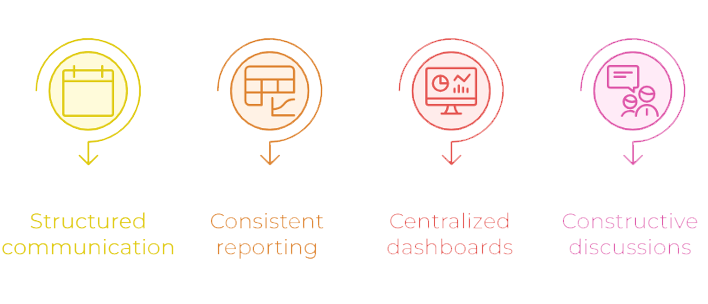

Transparency forms the backbone of every healthy investor-founder relationship. Founders operate under intense pressure, and the predictability of investor communication offers stability. A transparent framework eliminates uncertainty and builds trust by creating a shared rhythm of engagement.

A strong transparency system includes:

- Structured communication cadences such as monthly updates and quarterly reviews.

- Consistent reporting templates that standardize key metrics and qualitative insights.

- Centralized dashboards that make performance visible to both parties.

- Constructive discussions, where data is contextualized with real business narratives.

Transparency does not mean micromanagement, it means clarity and consistency. When founders know what to expect, communication becomes proactive rather than reactive. Over time, this structured approach builds a foundation of mutual respect and accountability that allows both sides to focus on what truly matters: growth.

4. Strategic Alignment and Goal Setting

Alignment is not a formality, it is the foundation upon which growth is built. When investors and founders share a strategic compass, execution becomes smoother, faster, and more meaningful. Misalignment, on the other hand, drains time, focus, and morale.

Right after investment, leading funds organize deep-dive sessions to align on strategy and define measurable goals. These sessions establish shared understanding around company vision, operational priorities, and key risks. Strategic goals should be revisited quarterly, ensuring agility in a changing market environment.

This process transforms investors from observers into collaborators. It creates a shared sense of ownership and direction, allowing the company to operate with clarity. When both sides move in sync, execution becomes faster, capital is used more efficiently, and the likelihood of long-term success increases significantly.

5. Operational Enablement and Scaling Support

Innovation sparks a company’s birth, but operational excellence ensures its survival. As startups transition from early validation to rapid scale, operational complexity increases, and without guidance, growth can outpace control.

Investors bring immense value by introducing structure. This includes helping teams set up performance dashboards, define internal KPIs, and implement project management systems. Simple frameworks like OKRs or agile routines can dramatically improve organizational focus. Funds can also connect founders to trusted legal, HR, and financial partners, avoiding the inefficiencies of trial and error.

Operational enablement ensures that founders can focus on what they do best, building products and leading teams, while internal systems handle execution. Over time, these improvements create sustainable scalability, reducing dependency on founders and building resilience within the organization.

6. Talent and Leadership Development

No company grows faster than its leadership capacity. People are the true multiplier of value, and investors who help founders build strong teams contribute far more than capital ever could.

Leadership support begins with understanding the company’s evolving structure, what roles are missing, where gaps in management exist, and how to anticipate hiring needs. Investors can provide access to executive recruiters, introduce advisors, or sponsor leadership development programs. Coaching founders on delegation, communication, and decision-making also has long-lasting impact.

Equally, creating a culture that retains talent is crucial. Funds that guide founders in designing ESOPs, building fair compensation structures, and establishing performance systems ensure stability through growth. Leadership maturity creates independence and strategic depth, qualities that define companies capable of thriving even beyond their founders.

7. Go-to-Market and Commercial Strategy

A startup without a market is just an idea. Translating innovation into revenue requires a clear, data-backed go-to-market strategy, and investors are in a unique position to help shape it.

Investors can help founders refine their value proposition, segment customers, and identify scalable acquisition channels. They can also challenge assumptions about pricing and positioning, ensuring that the business model is both defensible and profitable. In many cases, investors serve as connectors, introducing startups to corporate partners, early adopters, or regional distributors.

Commercial excellence doesn’t happen by chance. It’s built through structured experimentation, measurable feedback, and constant optimization. Funds that bring GTM expertise not only accelerate revenue but also reduce burn and improve unit economics, leading to stronger long-term financial health.

8. Technology and Product Roadmap Guidance

In the modern economy, technology is the architecture of scalability. It defines how fast a company can grow, how efficiently it operates, and how defensible its position becomes. Investors with technical understanding can be a game-changer for their portfolio.

Support can include:

The most effective investors ensure that technology choices align with long-term business value. By guiding founders toward sustainable product decisions, they help avoid overengineering, security risks, or technical debt. Over time, this builds a technological maturity that strengthens both valuation and exit potential.

9. Financial Planning and Fundraising Preparedness

Financial planning is the silent determinant of startup survival. Many early-stage companies underestimate the importance of financial forecasting, capital allocation, and investor reporting. A proactive fund plays a pivotal role in establishing financial discipline and fundraising readiness from day one.

This includes supporting founders in creating financial models, defining key performance metrics, and conducting scenario planning. Regular finance reviews ensure that the company’s burn rate, cash flow, and growth projections remain in sync. Investors can also help prepare pitch materials, manage data rooms, and connect founders with co-investors for follow-on rounds.

A company that understands its financial health makes better decisions and raises capital with confidence. In the eyes of future investors, financial clarity equals credibility, and that credibility often determines the speed and terms of the next funding round.

10. Ecosystem Connectivity and Strategic Partnerships

Startups rarely grow in isolation. Their success often depends on the quality of the ecosystem around them, the networks, customers, and partners they access. Investors, with their position at the center of these networks, can unlock powerful synergies.

This support can take the form of introductions to corporates for pilot programs, partnerships with government or academic institutions, or collaborations between portfolio companies. Investors can also connect founders to accelerators, innovation hubs, and international networks that extend their market reach.

Strong ecosystems compound value across the portfolio. When founders share experiences, resources, and even clients, the fund’s overall competitiveness rises. In this sense, connectivity becomes a strategic currency, and funds that cultivate it multiply their influence far beyond individual investments.

11. Crisis Management and Resilience Building

Every portfolio faces turbulence, missed targets, delayed launches, or market downturns. In those moments, investors prove their real worth. Crisis management is not about avoiding challenges but guiding founders through them with composure and clarity.

Effective investors act early. They communicate openly about risks, identify immediate priorities, and co-design recovery plans. Their role extends beyond financial advice, they provide psychological safety and pragmatic optimism. Founders who feel supported are more likely to navigate uncertainty without losing direction.

Crises test relationships, but they also build them. The funds that handle downturns with transparency and empathy create founders for life, individuals who will choose to work with them again, even after failure.

12. Measuring Impact and Portfolio Health

You cannot improve what you do not measure. Just as startups track customer satisfaction, funds should track portfolio engagement effectiveness. Quantifying impact ensures that portfolio support remains intentional and data-driven.

Key indicators can include revenue growth post-support, founder satisfaction surveys, leadership retention, or the ratio of follow-on funding secured. Qualitative insights such as founder testimonials and partnership outcomes complement these metrics to provide a holistic view of value creation.

By institutionalizing measurement, funds move from anecdotal evidence to performance accountability. The data not only helps optimize internal processes but also strengthens credibility with LPs who seek transparency and proof of value creation.

13. Leveraging Technology for Portfolio Management

Technology now plays an essential role in scaling portfolio management efficiently. As funds expand across geographies and sectors, digital tools enable structured engagement, analytics, and knowledge sharing.

CRM platforms, data dashboards, and AI-driven reporting systems help investors track communication, monitor performance, and detect early warning signs. Centralized data repositories also simplify due diligence, audits, and investor updates. The goal is not automation for its own sake but visibility and precision in managing portfolio relationships.

Digitally mature funds demonstrate discipline and reliability. They operate with the same analytical rigor they expect from their startups, and that consistency enhances their credibility across the ecosystem.

14. Long-Term Relationship Building and Re-Investment Potential

The relationship between an investor and a founder doesn’t end at exit. Long-term engagement transforms transactions into partnerships, fostering mutual loyalty and collaboration. Founders who feel genuinely supported often become future co-investors, advisors, or even LPs.

Funds can nurture this continuity through alumni networks, portfolio events, and shared success storytelling. Celebrating milestones and creating spaces for peer learning keeps the connection alive. These relationships often translate into early access to new opportunities and referrals for high-quality deals.

Ultimately, loyalty compounds faster than capital. By maintaining authentic engagement, funds build a community of founders who advocate for them, creating a self-reinforcing cycle of trust and opportunity.

15. Turning Portfolio Support into Competitive Advantage

In today’s crowded investment landscape, value creation beyond capital is the new standard. Funds that systematize portfolio support stand out as strategic operators, not just financiers.

A strong support infrastructure attracts better founders, ensures faster scaling, and strengthens LP confidence. It also generates goodwill and reputation, two assets that cannot be bought or measured easily. When portfolio support becomes part of a fund’s DNA, it transforms into a self-sustaining advantage.

The most successful funds don’t just invest in companies, they invest in ecosystems, relationships, and people. Their capital opens doors, but their support keeps them open. In the long run, that is what defines enduring success in venture capital.